Instead of pursuing growth simply for the sake of growth, we strategically identify opportunities that we’re confident will drive the best possible outcomes. This directly benefits our partners, residents, and the greater community. As a result, we’ve maintained long-term relationships with investors who trust us to preserve capital and grow wealth.

A fresh approach to multifamily investment

Criteria

Based on our decades of experience and expertise in the market, we’re expanding our socially responsible multifamily investment platform to encompass two distinct strategies in order to bolster our portfolio and ensure continued long-term success:

VALUE-ADD MULTIFAMILY INVESTMENTS

CORE-PLUS MULTIFAMILY INVESTMENTS

Success Stories

Confidential Portfolio

Post Road Management, in partnership with an NYC family office, acquired a 5,500-unit distressed portfolio of multifamily properties located across five states from a special servicer.

Through strategically executing a business plan including significant capital expenditures, lease-up for down units, and programmatic value-add repositioning, we increased NOI from $14 million at the time of acquisition to over $26 million at the time of sale and achieved nearly $120 million in profits over a 5.5-year hold.

PURCHASE PRICE

$231M

SALE PRICE

$390M

Kutztown View

Post Road Management acquired Briar Cliff as a 101-unit distressed student housing property at 40% occupancy and in significant need of capital improvements.

Over a three-year hold, we completed extensive renovations including new HVAC systems, paving, roofing, and entire unit upgrades. We successfully converted the property to market-rate housing, achieving full occupancy and increasing NOI from $206,000 to $1.04 million.

*Unrealized, based on today’s value.

PURCHASE PRICE

$5.5M

CURRENT VALUE

$17.5M

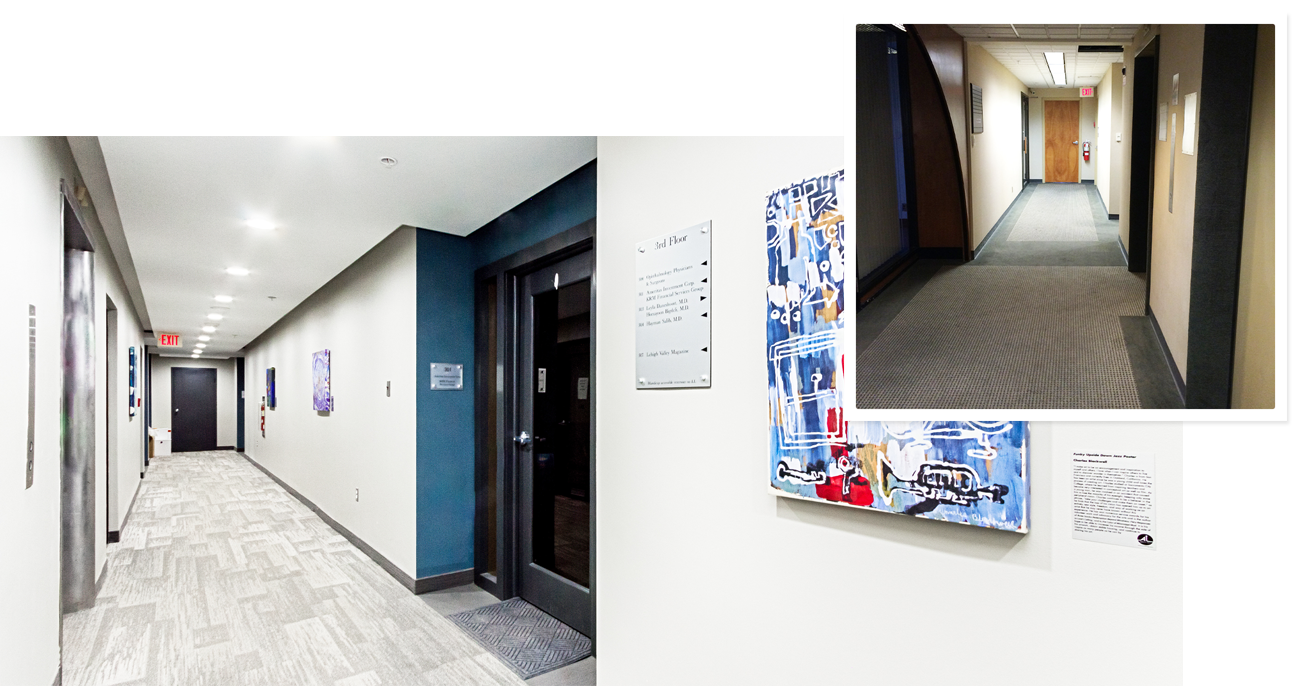

The Pinnacle @ 65

Post Road Management strategically repositioned this 10-story commercial office building, acquired at just 22% occupancy, into a mixed-use property featuring 48 Class A multifamily units and upgraded commercial spaces – ultimately achieving 93% occupancy in just under four years.

PURCHASE PRICE

$2.55M

SALE PRICE

$15.33M

Before & After

41-45 N. 9th STREET, ALLENTOWN, PA

912-914 CENTRE STREET, EASTON, PA